The world needs an exit ramp off the highway to climate hell

UN Secretary-General Antonio Guterres said last Wednesday: “the world needs an exit ramp off the highway to climate hell”, as the latest data showed the streak of record global temperatures stretched into a 12th consecutive month in May.

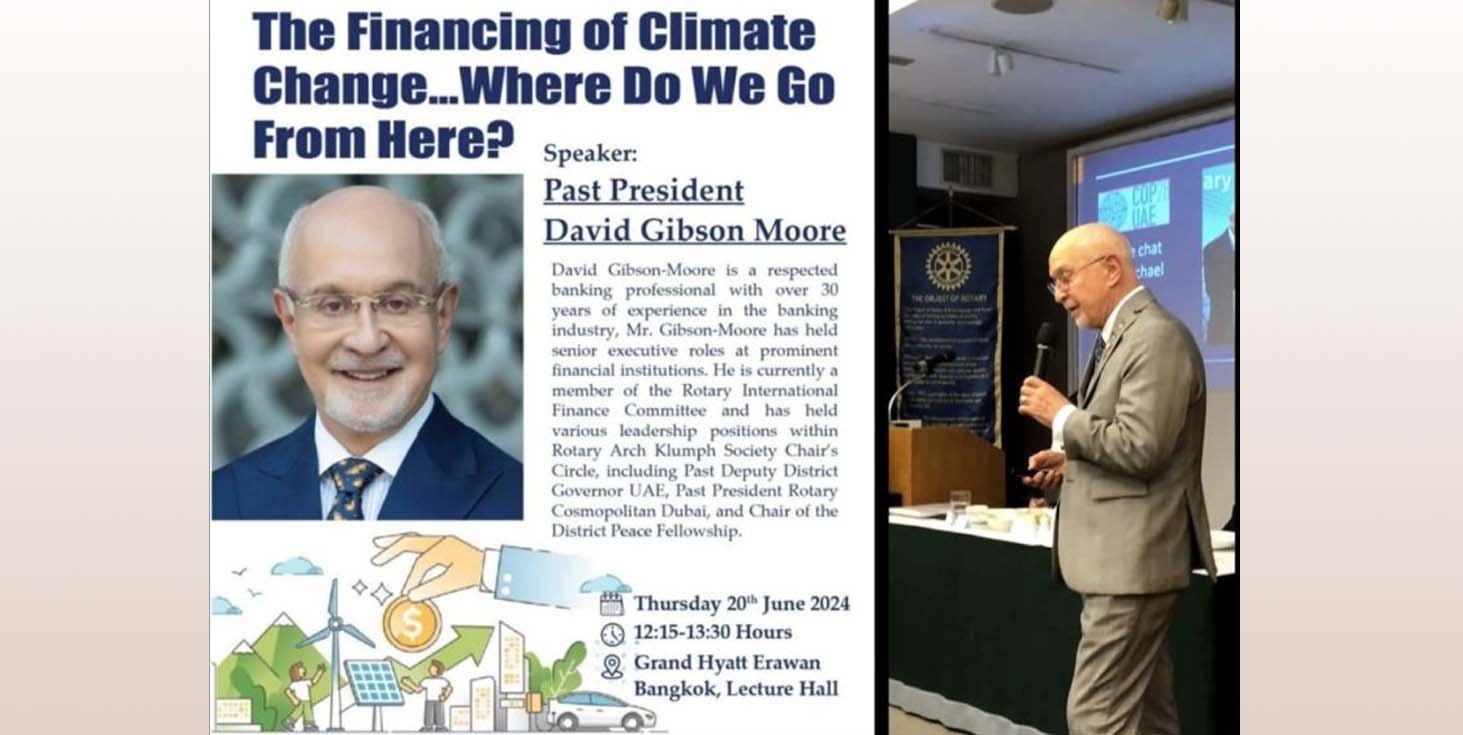

Last week, I had the privilege of addressing Rotary Club Bangkok DACH on the critical issue of financing climate change. It was useful to be able to draw on experiences gained at COP28 in Dubai and subsequent ESG conferences in the UAE and elsewhere.

Achieving the Paris Agreement target of limiting global warming to 1.5°C by 2030 is not just an environmental imperative but a financial challenge of unprecedented scale. A vast funding gap, estimated at around $7.6 trillion per year, is needed annually compared with the $1.3 trillion currently being spent (according to a 2023 WMO report, The State of Global Climate).

Quite apart from the massive financial deficit mentioned above, other challenges are mounting. Many studies show the projects underlying carbon credits' value are deficient, incorrectly certified, and in some cases, even leading to higher emissions. A recent Financial Times article highlights how investors are pulling assets out of ESG funds due to lagging performance (https://on.ft.com/4e3afxX). Another describes how many companies are either dropping or missing green targets originally set up to cut emissions (https://on.ft.com/3xikVrZ).

We may well have to dust off the degrowth theory and focus on the steady-state economic model. The relentless push for GDP growth will then be replaced with goals focusing on long-term stability, environmental sustainability, and social well-being as our principal objectives.

John Kerry, who recently stepped down from his role as the US special climate envoy, put it bluntly: “The Paris 1.5°C target is dead. We do stand next to an abyss. It is the test of our own times, a test as acute and as existential as any previous one. It is about survival.”

Those of us working in the financial sector especially will have to redouble our efforts to confront this immense challenge.

View Article Source